Blogs

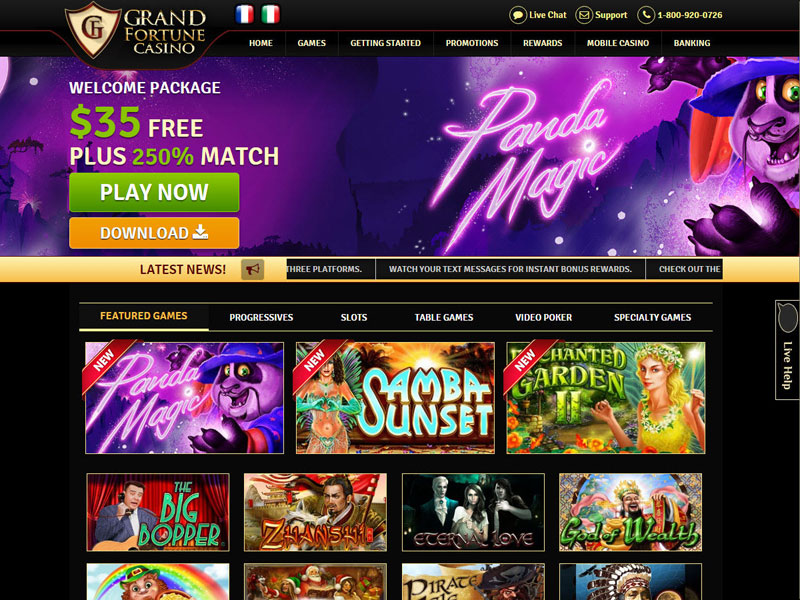

It’s normal observe no-put incentive codes while offering attached to a certain on the web slot or local casino game. No-put extra fund enables you to try out online slots games and you will gambling establishment video game without the need for any of your individual money. A no-deposit bonus quickly adds local casino credit to your account, however, below are a few points just be conscious of just before saying a deal.

(Upgraded 2 July Best Singapore Repaired Deposit Cost and you can Discounts Profile

Instead, enter into “-0-” to the month and carry over the newest vacant part of the changes to the next week. When the range a dozen is actually $2,500 or more for the each other their earlier and you can newest one-fourth Variations 941, and you’ve placed the taxation when due, the bill owed on the web 14 will likely be zero. If you spend by the EFT, bank card, otherwise debit cards, file the return utilizing the Instead an installment address less than Where Should you decide File, before, and do not document Form 941-V, Commission Coupon. Enter into income tax number to the contours 7–9 you to definitely come from newest one-fourth modifications.

- However, you might have to supply the payer that have an enthusiastic SSN to avoid withholding.

- If range twelve is actually $dos,500 or more on the both their past and current quarter Models 941, and also you’ve deposited the taxes whenever owed, the bill owed on line 14 will be no.

- Underneath the COVID-associated Tax Rescue Operate of 2020, the fresh Irs has produced more than 147 million EIPs (stimulus repayments) totaling over $142 billion.

- Money thresholds will stay according to the new stimuli take a look at profile, nevertheless the restriction constraints was lower for every the fresh table a lot more than.

- Risk.all of us has many constant advertisements as a result of their well-known Stake You bonus lose password system which includes everyday bonus packages, a regular raffle, and multiplier drops to boost the bankroll.

- Checking account interest levels will continue to be relatively packed with 2025.

Minimum equilibrium

Payroll income tax credit without a doubt tax-excused organizations affected by qualified disasters. The brand new Medicare tax price try step one.45% for every on the staff and company, undamaged from 2024. If the family currently has an Oregon EBT membership, the advantages might possibly be put in your existing card. For eligible people that do maybe not currently have an enthusiastic Oregon EBT card, you to definitely will be sent to your newest address on the file. Simultaneously, most other laws and constraints are usually set up. For instance, there is often a primary termination several months, so you must have fun with the advantage and you can meet the brand new betting requirements pretty quickly.

Enter into all of the wages, info, unwell spend, and you will taxable fringe pros which might be at the mercy of A lot more Medicare Taxation withholding. You’re also necessary to initiate withholding A lot more Medicare Income tax regarding the spend months for which you shell out wages more than $200,000 to a i was reading this member of staff and you will still keep back it for every spend several months before the avoid of the twelve months. All the earnings that are susceptible to Medicare tax is at the mercy of More Medicare Income tax withholding if paid-in excess of the newest $200,100 withholding threshold. To possess 2025, the interest rate out of personal defense income tax for the nonexempt earnings is 6.2% (0.062) for every on the employer and you will employee. Prevent spending social defense taxation to the and you can entering an employee’s earnings on the web 5a if employee’s nonexempt wages and you can tips arrive at $176,a hundred to your seasons. Although not, consistently keep back income and you can Medicare fees for your seasons on the all of the wages and you may information, even when the social security wage base from $176,100 has been achieved.

Regarding free spins and you may incentive fund, we have seen particular product sales whose accessibility utilizes the kind of equipment make use of, but this is extremely uncommon. Really no-deposit gambling establishment bonuses are around for one another cellular and you will desktop computer professionals. No deposit gambling establishment bonuses leave you an opportunity to enjoy gambling enterprise games with incentive financing and win certain real cash in the processes. That being said, the advantage number were a bit small and – that have restrictive Small print that always implement – you almost certainly will not be able to earn and money away huge amounts. When you claim a no-deposit incentive, you always need meet with the betting standards.

Examining profile are ideal for those who want to keep their money safe when you’re nonetheless that have easy, day-to-day usage of their funds. Neither Atomic Invest nor Nuclear Broker, nor any one of their associates are a financial. Assets in the ties commonly FDIC insured, Maybe not Bank Protected, and may Lose Really worth.

Bankrate

Yes, BetMGM bonuses and you will offers are available to cellular pages. This consists of the fresh BetMGM invited incentive as well as other incentives and you may promotions for example possibility boosts, parlay insurance also offers, Zero Perspiration Tokens, and. Fool around with BetMGM incentive password SI1500 to open an extra-opportunity bet worth around $step 1,five hundred. BetMGM often get back their initial stake completely when it comes to bonus wagers, up to $1,five-hundred if your basic bet settles while the a loss. Being a crypto-friendly gambling enterprise ensures that you possibly can make dumps inside cryptocurrencies, as well as Bitcoin, Litecoin, Dogecoin, and you will Ethereum.

If they’re artificially pushed too high, they generate monetary issues. When they artificially forced as well low, they generate economic issues. Even when no-one can expect the long run (so far as we realize), advantages try discovering the economic tea-leaves and can allow us to know where cost was supposed in the near future. One equipment, the brand new CME FedWatch device, music the new viewpoints of interest rate people for the probability of whether the Fed will be different the new federal financing rate during the the then meetings.

To qualify since the ill shell out, it needs to be paid back less than a plan to which your boss try a party. The tips you report to your employer try measured as a key part of your own earnings to the month you statement him or her. Your employer is also figure their withholding in both out of a couple suggests. When you yourself have multiple jobs, build another report to per employer. Report precisely the tips you received while you are employed by one to boss, and only whenever they overall $20 or maybe more to your few days. For those who discovered resources of $20 or more within a month if you are helping anyone workplace, you ought to are accountable to your boss the amount of resources you get hands on in the few days.

In the event the in initial deposit is needed to be manufactured to the day this isn’t a corporate go out, the new deposit is regarded as prompt in case it is produced by the newest romantic of the 2nd working day. A business day is one day aside from a saturday, Weekend, otherwise judge vacation. The definition of “courtroom holiday” to possess put objectives includes solely those court holidays in the Region away from Columbia. Court vacations regarding the Region out of Columbia are provided inside part 11 from Pub. Also engaging in online gambling is known as a criminal work, even if nobody has been faced with so it, therefore legal online poker and you may gambling enterprises don’t become sexual at all.

The brand new Irs can give a time during which your can be dispute the newest determination before your employer adjusts the withholding. Contact details (a toll-totally free number and you may an Internal revenue service workplace target) will be provided in the secure-inside letter. After this period, for many who retreat’t responded or if your own response isn’t enough, your employer are needed so you can keep back in accordance with the unique lock-in the page. You might have to tend to be it matter whenever figuring the projected taxation. You can even request that your particular company deduct and you will keep back an enthusiastic extra amount of tax withholding out of your wages to your Mode W-cuatro.

You can view, obtain, or print all of the forms, recommendations, and you may books you’ll need from the Irs.gov/Forms. If you don’t, you can visit Irs.gov/OrderForms to get your order and also have her or him shipped to you. The new Internal revenue service tend to process the transaction to have models and you will publications as the soon you could. The brand new agreement usually automatically expire one year in the due date (instead of mention of the extensions) for processing your Form 941. For many who otherwise the designee wants to terminate the fresh authorization, produce to your Internal revenue service workplace for the area by using the Instead of a payment address under Where If you Document, earlier. As well as, when you complete Function 941, be sure to browse the field on top of your own function you to represents the new quarter advertised.

Find listing of acting banking institutions during the SoFi.com/banking/fdic/participatingbanks. Investment You’re a brick-and-mortar financial that provides sets from playing cards so you can bank account, automotive loans, business and you can industrial banking. Investment You’ve got from the 300 branches and 70,000-in addition to percentage-totally free ATMs all over the country. Openbank Higher Give Discounts is for those who favor banking to your their mobile phone since the pages create the high-give savings account myself through the Openbank mobile software, and they have to have deal with otherwise fingerprint detection. All the details inside article is actually for informational objectives only and will not constitute monetary guidance.

You have to make adjustments both for changes in the state as well as previous alterations in the brand new income tax law. These changes is mentioned before lower than What’s The new for 2025. To possess information about these types of or any other changes in what the law states, visit the Internal revenue service webpages during the Internal revenue service.gov.